Housing Cost Report 2024

For nine years now, the ACCENTRO Housing Cost Report has analysed the costs of owner-occupying your home and compared them to equivalent rental costs. It has arguably established itself as an indispensable instrument for investors and prospective buyers who understand the German real estate market and plan to take a strategic approach to it.

This year’s Housing Cost Report shows that residential real estate in Germany remains an investment of long-term appeal. The survey, which was once again compiled together with the German Economic Institute (IW), measured average owner-occupier costs of 13.14 euros per square metre for the year 2023. Despite the elevated interest rates, buying a home was therefore still more affordable in 127 out of a total of 401 rural and urban districts in Germany.

Buyers who bring sufficient equity capital to the table can take advantage of attractive opportunities in this market. The report underscores the long-term opportunities and chances for returns that Germany’s residential real estate market offers investors. In cooperation with

Turning Point for Owner-Occupier Costs

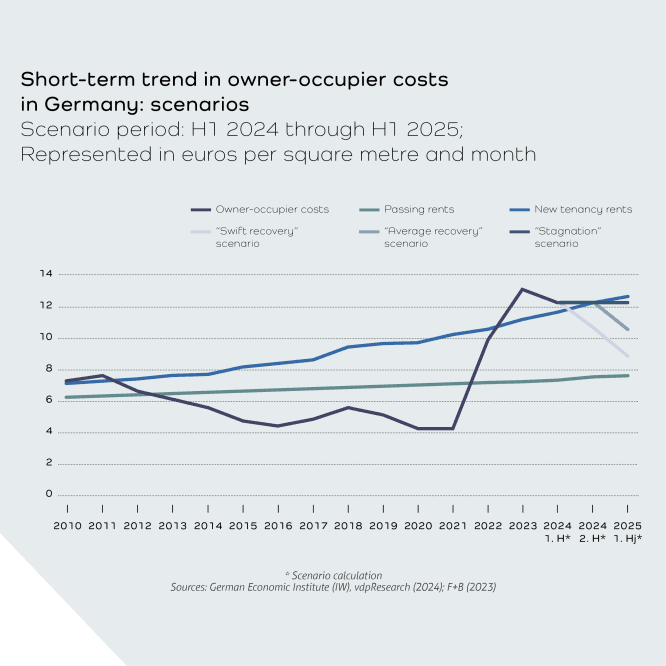

Owner-occupier costs experienced another year-on-year increase in 2023. This is mainly explained by the high interest on borrowed capital. In fact, the interest rate reversal on the real estate market in 2022 and further interest hikes in 2023 put homeownership at a certain cost disadvantage vis-à-vis renting. But signs of a trend reversal have emerged in the course of 2024. As interest rates fall and new-tenancy rents keep rising, the relative economic benefits of homeownership will continue to increase.

Major Differences from One Region to the Next

The ACCENTRO Housing Cost Report 2024 reveals substantial regional differences among owner-occupier costs. In certain districts, such as Oder-Spree and Dahme-Spreewald near Berlin, the cost advantages are quite significant. In fact, homeownership remains more affordable than renting in the suburban regions of the “Big 7” cities in general. The regional differences translate into diverse opportunities for investors because owner-occupying your home has stayed more affordable in many rural parts of the country.

Moderate Drop in Interest Rates Encourages Prospective Buyers

The report predicts that interest rate cuts could start bringing down owner-occupier costs as early as 2024, and significantly so. Scenario calculations suggest that lowering interest rates by 50 basis points per half-year as of mid-2024 will push owner-occupier costs down to 9 euros by 2025.

The growing affordability of homeownership is likely to attract more buyers and to drive an increase in the transaction volume during the second half-year of 2024.

Attractive Long-Term Returns

The return triangle developed for the ACCENTRO Housing Cost Report 2024 maps the average annual returns realised in the housing market. It shows that, between 1970 and 2023, Germany’s residential real estate achieved a real total return of 5.4 percent. The figure underlines the intrinsically stable value of homeownership. Total rates of return have traditionally been quick to recover in the wake of crises. The data indicate that total returns will maintain an historically above-average level in the 2020s because apartments are in very short supply in many of Germany’s conurbations.

Your contact to ACCENTRO

Address

ACCENTRO Berlin

Kantstraße 44/45

10625 Berlin